Web and mobile continue to be the platforms that get all the buzz, but when it comes to advertising dollars, traditional media continues to rule the roost.

Web and mobile continue to be the platforms that get all the buzz, but when it comes to advertising dollars, traditional media continues to rule the roost.

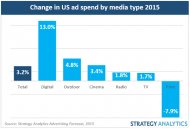

Strategy Analytics has published its latest figures for advertising spend in the U.S., and in an overall pot that it estimates at nearly $187 billion, digital will account for just under 30% of that — 28%, or $52.8 billion, to be exact, putting it nearly $30 billion behind TV ad spending. However, growing at a rate of 13% this year, and up 2.5% on 2014’s share, digital remains the fastest-growing of any category.

TV, meanwhile, will account for the single biggest share of ad spend in 2015, with 42% of spend, or nearly $79 billion. That is down -0.6% on 2014. Print, in third place for ad spend after digital, will account for 15%, or $28 billion, of ad spend. Paper-based ads will be the only category to decline this year, write the analysts. It’s also down 1.8% on 2014.

The growth in digital may be the highest of any category, but it’s not enough to boost the overall sluggish picture for advertising will continue to deep the market down, growing just 3.2% in 2015.

The growth in digital may be the highest of any category, but it’s not enough to boost the overall sluggish picture for advertising will continue to deep the market down, growing just 3.2% in 2015.

“Despite digital’s best efforts, the drop in traditional ad revenues means we’ll see fairly modest growth in overall U.S. ad revenues in 2015 and will have to wait for more significant growth in 2016, courtesy of the U.S. presidential elections and summer Olympics, ” writes Michael Goodman, an analyst at the firm.

Goodman says that social media — advertising on sites like Facebook and Twitter — will see the most growth at 31% this year, followed by video (29%) and mobile (20%). Search — and Google — will this year continue to account for the biggest proportion of spend, at 45% of all digital ad revenues.

Longer term, the same trends will continue for the next three years to come.

“By 2018, TV’s share of ad revenue will fall to 40% whilst digital’s will have grown to 35%, ” writes co-author Leika Kawasaki. “However, TV’s declining share is less about ad dollars flowing out of TV and more about dollars flowing into digital from print and radio. TV networks such as ABC, NBC, MTV and the like will see little, if any, real decline in revenues, just a shift in the source from linear TV ads to online video.” Similarly, within the category of digital, we’ll see social media pulling away from the pack, widening its margin with mobile ads to take up $8.2 billion of spend, versus $7.4 billion for mobile ads.