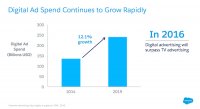

1. Digital advertising spend continues to grow rapidly

Globally, digital advertising is forecasted by PWC to grow from $135 billion in 2014 to $240 billion in 2019, a compound annual growth rate (CAGR) over the period of 12.1%. In Q3 2015, U.S. digital ad revenue reached $15 billion, which is a full 23% increase over Q3 2014, according to the IAB and PWC. At the same time, Magna Global just forecasted that in 2016, digital advertising will surpass television advertising for the first time, with $66B in revenue in the U.S. This is made even more remarkable because it is an accelerating trend globally - last year, Magna Global and PWC forecasted that digital advertising would pass TV in 2017.

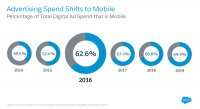

2. As advertising spend grows, it also shifts to mobile

When we look at the growth of digital advertising, those numbers are built on the massive growth in mobile advertising. In 2015, for the first time, more advertising was spent on mobile than on desktop ads. As everyone spends more time on mobile, with three hours and eight minutes spent per US adult daily this year, this trend will grow. The percentage spend on mobile is forecasted by eMarketer to grow to 63% this year, 70% (or $65B) by 2019. When we look at mobile advertising, the growth of Facebook, Twitter, and Instagram are the largest factors; Facebook is predicted to reach .3 billion in mobile revenue in 2016, more than 3x the mobile ad revenue of Google.

When we look at the growth of digital advertising, those numbers are built on the massive growth in mobile advertising. In 2015, for the first time, more advertising was spent on mobile than on desktop ads. As everyone spends more time on mobile, with three hours and eight minutes spent per US adult daily this year, this trend will grow. The percentage spend on mobile is forecasted by eMarketer to grow to 63% this year, 70% (or $65B) by 2019. When we look at mobile advertising, the growth of Facebook, Twitter, and Instagram are the largest factors; Facebook is predicted to reach .3 billion in mobile revenue in 2016, more than 3x the mobile ad revenue of Google.

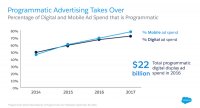

3. Programmatic advertising takes over

3. Programmatic advertising takes over

The growth of mobile advertising is mirrored by the growth in programmatic advertising. In 2014, just under half of all display advertising was purchased programmatically, or through a technology platform and an API. In 2016, 67% of all display ads will be purchased programmatically. Mobile programmatic ad revenue will reach $9.3 billion this year according to eMarketer, and marketers in the U.S. cite mobile as having the most opportunity for programmatic buying. Both Facebook and Google have led this change, as their advertising products are programmatic.