Facebook’s undisputed victory in ad personalization is driving Google to make changes to its advertising business, according to Adobe Digital Index’s “Q3 Digital Advertising & Social Intelligence Report.”

Facebook’s undisputed victory in ad personalization is driving Google to make changes to its advertising business, according to Adobe Digital Index’s “Q3 Digital Advertising & Social Intelligence Report.”

Google’s recent release of Customer Match–a new tool that helps advertisers personalize display ads based on historic search data–is a direct response to consumers’ finding Facebook ads (51%) more relevant than Google’s display ads, the majority of which run on YouTube (17%), ADI posited. Google+ (6%) and Pinterest (6%) were the next-best rated, so Google is undoubtedly feeling the heat.

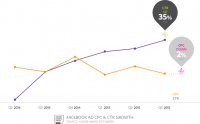

“Facebook ad click-through rates rose 35% year over year, indicating that targeting efforts are paying off, ” said Tamara Gaffney, principal analyst at ADI. “Marketers are using the platform more, and impressions are rebounding.”

As part of its analysis, ADI looked at consumer activity on branded sites from Q3 2014 to Q3 2015. It analyzed more than 900 billion digital ad impressions from search and social platforms (Google, Facebook, Bing, Yahoo!, Baidu, and Yandex), and also looked at more than 23 billion referred social visits from Facebook, Twitter, Pinterest, Tumblr, Reddit, YouTube, and LinkedIn.

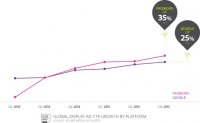

According to ADI, Google’s display click-through rates (CTRs) are up 25% YoY. Here again, Facebook outperforms in terms of display CTR, up 35% YoY. The Customer Match announcement demonstrates that Google is under pressure to better leverage targeting data in order to improve its performance, ADI maintains.

The Customer Match announcement demonstrates that Google is under pressure to better leverage targeting data in order to improve its performance, ADI maintains.

“Google’s CTR continued growth amid declining costs is likely due to the influence of programmatic media buying, ” said Matt Roberts, an ADI senior analyst. “It demonstrates that display remains a compelling opportunity. We’ll watch to see what impact Customer Match has going forward.”

Search

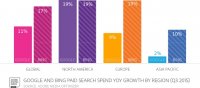

North America, according to ADI, is in the lead for growth in search marketing spend, for which Roberts attributed to the relative strength of the U.S. economy. “It is likely that economic differences are the key driver for regional trends, ” he told CMO.com. Indeed, paid search spend increased 17% YoY, with click-through rates in North America on the rise and cost-per-click (CPC) flat for the same period.

Interestingly, Bing surpassed Google in paid search spend growth in all regions around the world except North America. It should be noted that Google remains in the catbird seat, though, with 71% market share of paid search spend in North America, according to ADI. Google also continues to dominate from an optimization efficiency, with CTRs up 16%.

Interestingly, Bing surpassed Google in paid search spend growth in all regions around the world except North America. It should be noted that Google remains in the catbird seat, though, with 71% market share of paid search spend in North America, according to ADI. Google also continues to dominate from an optimization efficiency, with CTRs up 16%.

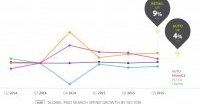

In comparing industries, retail—unsurprisingly—is still driving the highest paid search growth, Roberts said. He said he expects that number to continue to grow this quarter, when retailers double up on their efforts to drive holiday sales.

Also in Q4, an important time for many advertisers, ADI predicts the U.S. auto and retail industries will drive the most dollars in the digital advertising marketplace. The automotive sector, in particular, is fueling revenue with CPCs up 14% on better optimization of spending, as demonstrated through a healthy rise in CTRs, up 32%.

From a mobile perspective, the cost story has not improved much this year, with smartphone CPC growth relatively flat. CTR from mobile took an unexpected bounce up in the last quarter, a trend that retailers hope will continue during the Q4 holiday shopping period.

From a mobile perspective, the cost story has not improved much this year, with smartphone CPC growth relatively flat. CTR from mobile took an unexpected bounce up in the last quarter, a trend that retailers hope will continue during the Q4 holiday shopping period.

Social

According to the social intelligence portion of ADI’s report, revenue-per-visit (RPV) for traffic coming from social platforms is increasing across the board. It’s no surprise, however, that Facebook still leads the group with the highest referred RPV, followed by Pinterest. “What is interesting is how fast Reddit is closing the gap with the other social platforms, given the difficulties they have been facing of late, ” Roberts said. In fact, Reddit has almost caught up with Twitter by more than doubling its referred RPV.

Zeroing in on other social metrics, ADI found that although Facebook CTRs are up YoY, video, and image post interaction rates are down. “Changes made last summer to the Facebook algorithm were designed to favor the way in which links are displayed, ” Roberts said. “These changes are compelling marketers to allocate efforts to create engaging links while diverting attention away from images and videos.”

Periscope, the belle of the social ball in Q1 2015, continues to grow in usage, but it is struggling to gain mainstream adoption, according to ADI. ADI found a spike in social mentions in September, largely driven by the live streaming of a controversial movie banned in India. “This shows that adoption is still niche, ” Roberts said. “If a single event can cause this much volatility in usage, then this platform has yet to attain mass utilization.”

About Adobe Digital Index

Adobe Digital Index publishes research on digital marketing and other topics of interest to senior marketing and e-commerce executives across industries. Research is based on the analysis of select, anonymous, and aggregated data from over 5, 000 companies worldwide that use the Adobe Digital Marketing Cloud to obtain real-time data and analysis of activity on websites, social media, and advertising.

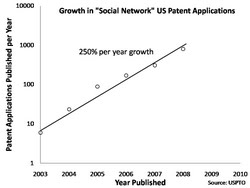

A social networking service is an online service, platform, or site that focuses on facilitating the building of social networks or social relations among people who, for example, share interests, activities, backgrounds, or real-life connections. A social network...

A social networking service is an online service, platform, or site that focuses on facilitating the building of social networks or social relations among people who, for example, share interests, activities, backgrounds, or real-life connections. A social network...